Main Differences Between Options and Stocks

The real differences? It comes down to ownership, risk, and how much cash you need to play the game.

Buying or selling stocks is slow and limited but simple, options on the other side can benefit you faster and in more ways but are a bit more complicated.

If you follow this guide you can learn everything you need to know at one place, just stay persistent.

Stocks and Options in Simple Terms

Stocks are shares – tiny slices of a business. When you buy them, you own a piece of the company. If the company pays dividends, you get a cut. You can hold onto your stocks for as long as you want.

Options are contracts. They let you buy or sell stocks at a certain price before a set date. Unlike stocks, buying options doesn’t make you an owner of anything. Instead, you’re making a bet on what the stock might do.

Simple.

Ownership vs. Contract Rights

Buying stocks and owning them means you might receive dividends on those stocks. You can hold it (the stock/its shares) until you decide to sell.

Options only give you rights for a limited time. No dividends. Once the contract expires, it’s gone – worthless if you didn’t use it.

Ownership at a glance:

| Stocks | Options |

| Permanent ownership | Temporary contract |

| Get dividends | No dividends |

| No expiration | Expires at a set date |

Leverage and Risk

With stocks, you could lose what you put in, but there’s no limit on how high the price can go. Options, on the other hand, can expire worthless. If that happens, you lose the entire premium you paid. The clock is always ticking with options—time decay eats away at their value as expiration gets closer.

That leverage means even tiny price moves can have a huge impact on your options. It can be thrilling or, honestly, a bit nerve-wracking.

How Investors Use Options and Stocks

People use stocks and options to reach different goals. Options can cut risk, boost returns with leverage, or help you build a flexible portfolio that balances growth and safety.

Protecting Yourself from Market Swings

Put options act like insurance for your stocks. Own some shares? Buy puts, and if prices drop, you’re covered. It’s a way to put a floor under your losses.

If this interests you, you can learn more about it here.

You can also sell call options on stocks you already own. That brings in extra income from the premiums. The catch? If the stock rockets past your strike price, you might have to sell your shares for less than they’re worth.

If this interests you, you can learn more about it here.

Hedging costs money up front. You pay premiums which eat into your returns. People hedge more when markets get wild – earnings, economic news,etc. If you want to sleep tight when markets are uncertain, this is what you can do with options.

Speculating and Chasing Big Gains

Options give you a possibility to control a lot of stock with a little cash. That leverage can make your gains huge—or your losses painful. A tiny move in the stock price can make your option explode in value or go to zero.

This is just one out of 4 possibilities they give you, you can learn more about this here.

Let’s get back to it, call options give you upside without buying the stock itself. You pay less up front, and if things go your way, you can make a lot more than if you just owned the shares.

But let’s be real: most options expire worthless – this means that most traders miss the timing or the direction. You need to be right about both, or you’re out the premium. It’s not for the faint of heart.

Day traders and short-term players love options for quick hits. The volatility can be a goldmine—or a money pit. Sometimes it feels like gambling more than investing.

Building a Portfolio That Works

A solid portfolio often mixes stocks for steady growth with options for strategy.

Stocks give you dividends and long-term gains.

Options add flexibility and a shot at extra income in the portfolio.

Stocks:

Some are in the portfolio just for holding and doing nothing with them and some are in it for income generation.

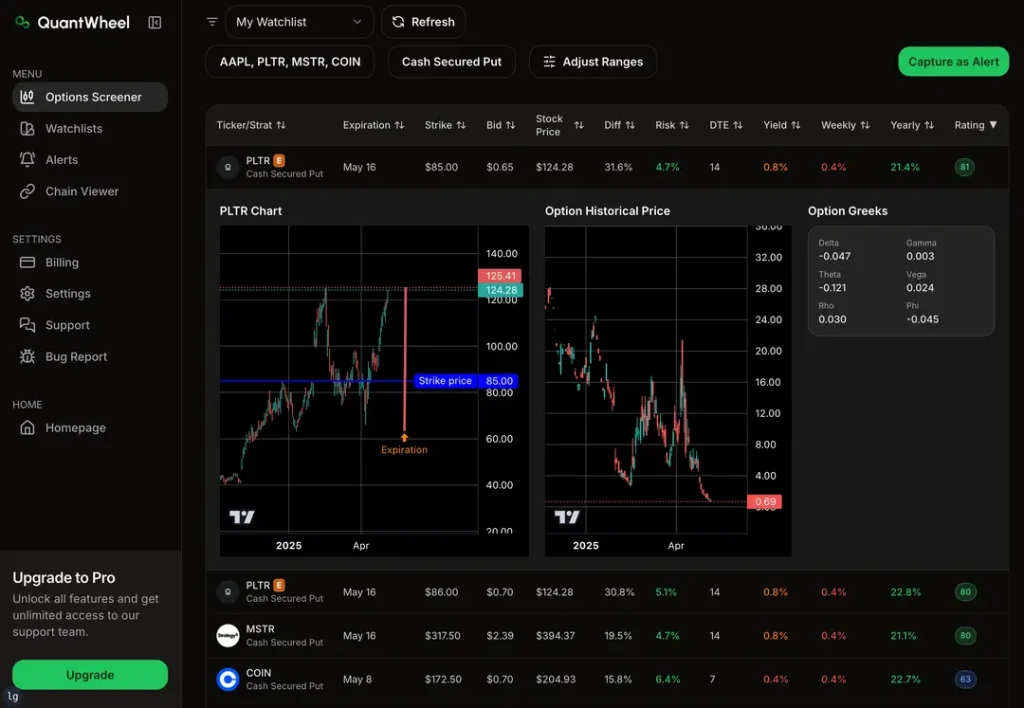

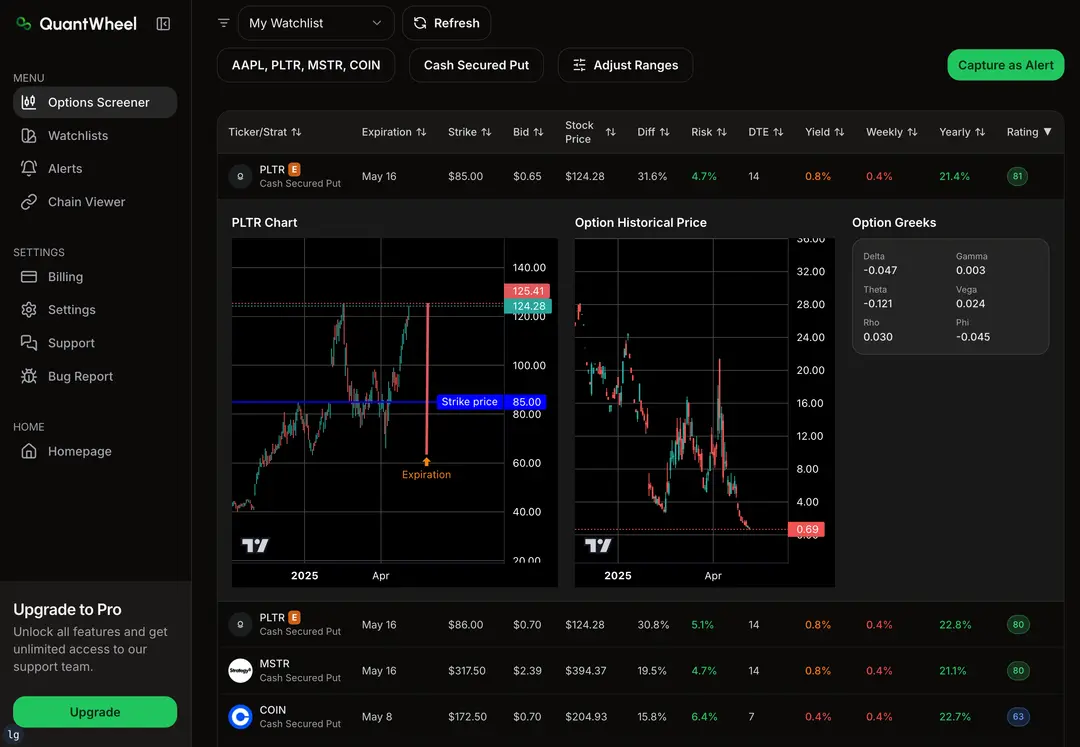

Investors collect income by selling covered calls on stocks they own.

It’s a conservative move that brings in premium income and keeps your shares working for you.

Options:

Others, who crave more action, might put 5-10% of their money into options trades.

That’s most often reserved for buying options which basically means betting on the direction, for example earnings or news.

The rest stays in safer stuff like for example bonds – or whatever fits their risk level.

Your own goals shape your mix. Younger investors might swing for the fences with options. Older ones often focus on income and protection, using covered calls or puts to keep things steady.