Options trading can seem like a mystery when prices move in unexpected ways. You might pick the right direction for a stock but still lose money on your options trade. Options Greeks are mathematical measurements that show how different factors affect an option’s price, helping you understand why options behave the way they do.

These Greek letters – Delta, Theta, Vega, and Gamma – each measure a specific risk in your options position. Delta shows how much your option price changes when the stock moves. Theta tells you how much value you lose each day from time decay.

Understanding Greeks gives you an edge in options trading. You can see which factors work for or against your position before you place a trade. This knowledge helps you avoid common mistakes that cost traders money even when they’re right about market direction.

What Are Greeks

Greeks are mathematical measures that help you understand how options prices change. These tools tell you what happens to your option’s value when different market conditions shift.

Options are derivatives that get their value from an underlying asset like a stock. When the stock price moves, your option’s value changes too. Greeks measure this relationship.

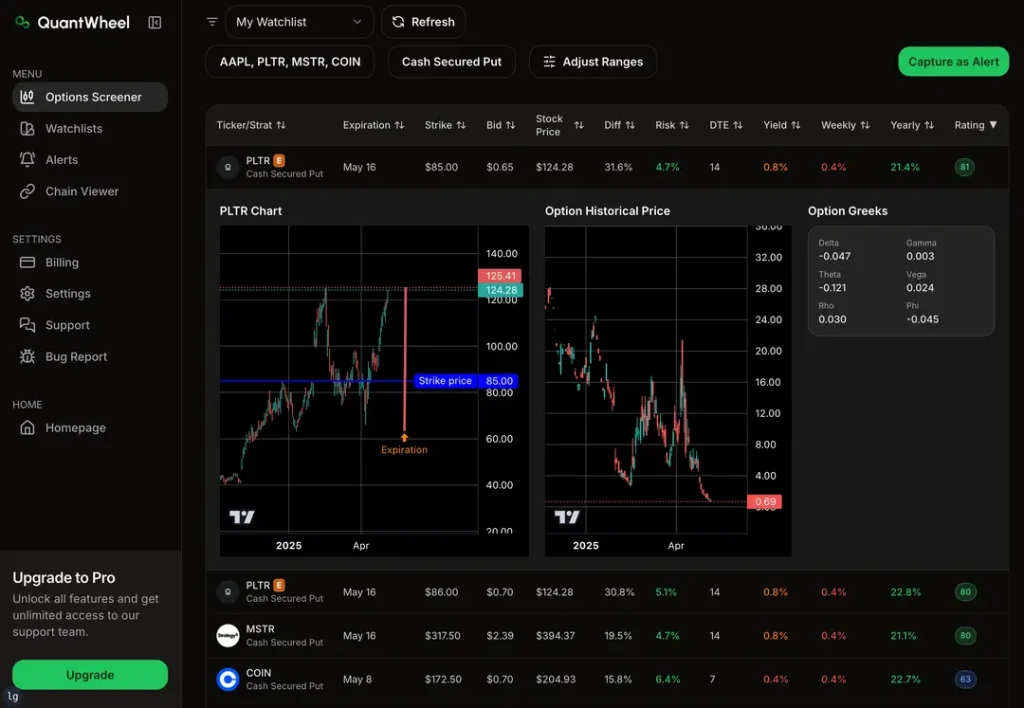

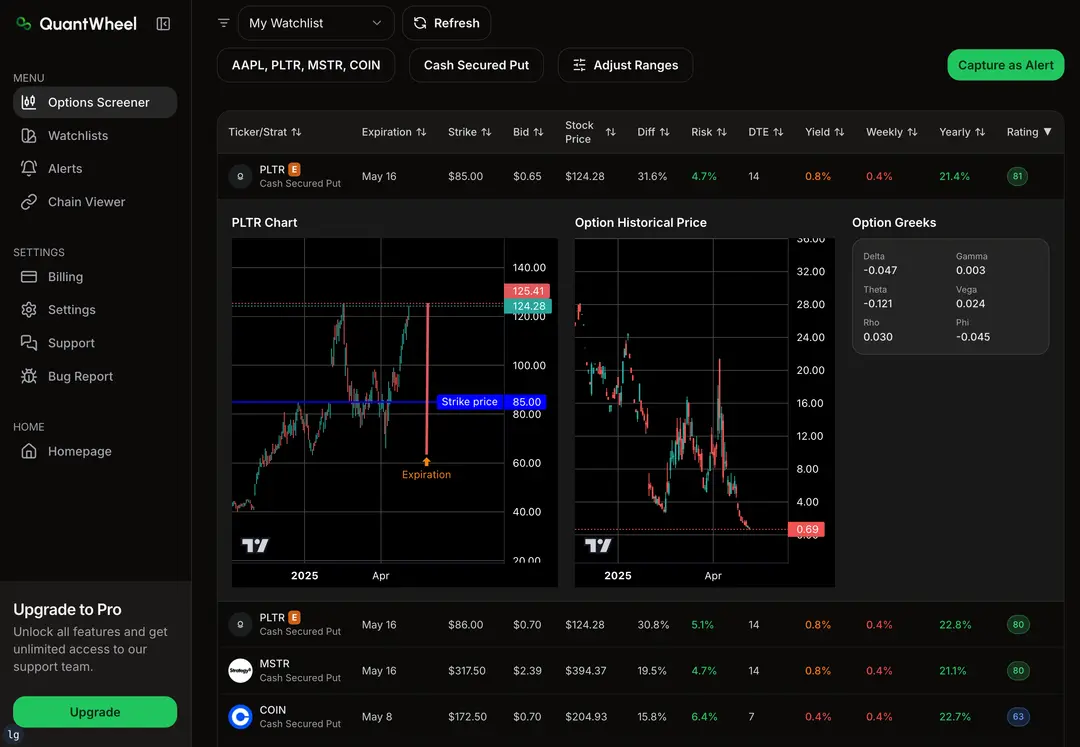

There are five main Greeks that option traders use:

- Delta – measures price changes

- Gamma – measures delta changes

- Theta – measures time decay

- Vega – measures volatility changes

- Rho – measures interest rate changes

Each Greek gives you a different piece of information about your option’s behavior. You can use these measures to make better trading decisions and manage risk.

Greeks help with portfolio management. If you own calls and puts, Greeks show your total exposure to different market moves. This lets you hedge positions or adjust your strategy.

Traders use Greeks for risk management too. You can see how much money you might lose if stocks drop or time passes. This helps you plan your investments better.

Understanding Greeks makes you a smarter trader. Instead of guessing what will happen to your options, you get clear measures of how they will react to market changes.

Investment firms and individual investors both rely on Greeks to analyze their derivative positions and make informed choices about their strategies.

How Greeks Work

Greeks measure how sensitive your option price is to different market factors. Each Greek tracks one specific risk that affects your contract value.

Delta shows how much your option price changes when the stock moves $1. If delta is 0.5, your option gains $0.50 when the stock rises $1.

Gamma measures how fast delta changes. High gamma means delta shifts quickly as the stock price moves.

Theta tracks time decay. It shows how much value your option loses each day. Time works against most positions.

Vega measures sensitivity to volatility changes. When market conditions get wild, vega shows the impact on your premium.

Rho tracks interest rate sensitivity. Most traders ignore rho because rate changes happen slowly.

| Greek | Measures | Risk Factor |

| Delta | Price sensitivity | Stock movement |

| Gamma | Delta changes | Price acceleration |

| Theta | Time decay | Days to expiration |

| Vega | Volatility impact | Market uncertainty |

| Rho | Rate sensitivity | Interest rates |

Greeks work together in pricing models. When one factor changes, it can affect multiple Greeks at once.

Your losses or gains depend on how these values interact. A position might have good delta but bad theta.

Market movement creates a range of possible outcomes. Greeks help you understand which factors pose the biggest risk to your contract value.

Most pricing models update Greeks constantly as market conditions change. This helps you track how sensitive your positions are to different factors.

Delta Deep Dive: Your Most Important Greek (Probability & Directional Risk)

Delta measures how much your option price changes when the stock moves $1. It also tells you the probability your option will expire in-the-money.

A call option with 0.30 delta means two things. The option price goes up 30 cents when the stock rises $1. Your option has a 30% chance of finishing ITM.

Delta ranges by option type:

- Call options: 0 to 1.00

- Put options: 0 to -1.00

Your strike price determines delta values. ATM options have deltas around 0.50 for calls and -0.50 for puts.

OTM call options have low deltas between 0.10 and 0.40. These options have less chance of expiring ITM.

ITM calls show high deltas from 0.60 to 1.00. Deep ITM options move almost dollar-for-dollar with the stock.

| Option Position | Typical Delta Range | Probability Meaning |

| OTM Calls | 0.10 – 0.40 | 10% – 40% chance ITM |

| ATM Calls | 0.45 – 0.55 | ~50% chance ITM |

| ITM Calls | 0.60 – 1.00 | 60% – 99% chance ITM |

Delta changes as your option moves closer to expiration. Time decay affects OTM deltas more than ITM deltas.

You can use delta to estimate your directional risk. Higher absolute delta values mean more price sensitivity to stock movement.

Theta Decay Acceleration: Why Short-Dated Options Bleed Faster Than Long-Dated

Theta measures how much an option’s price drops each day as time passes. This is called time decay.

Options with less time until expiration lose value much faster than options with more time left. The decay speeds up as you get closer to expiration day.

Here’s how theta works for different time periods:

| Time Until Expiration | Daily Theta Impact |

| 30+ days | Low decay rate |

| 10-30 days | Medium decay rate |

| 1-10 days | High decay rate |

| Same day | Extreme decay rate |

Short-dated options have higher theta values. This means they lose more money each day from time decay.

Long-dated options have lower theta values. They lose value slowly because there’s still plenty of time for the stock to move.

Think of it like ice melting. A small ice cube melts faster than a big one. Short-dated options are like small ice cubes.

The theta number gets bigger (more negative) as expiration gets closer. An option that loses $5 per day might jump to losing $20 per day in the final week.

This happens because all the option’s time value must decreases to zero by expiration. With less time left, each day represents a bigger chunk of the remaining time.

Weekend breaks make Monday theta even higher for weekly options. Theta theta keeps working even when markets are closed.

Vega & IV Crush: How You Can Be Right On Direction And Still Lose Money

Vega measures how much an option’s price changes when volatility moves up or down. When you buy options, you have positive vega. This means you lose money when volatility drops.

You can predict a stock’s direction perfectly but still lose money on your option trade. This happens because of IV crush.

IV crush occurs when implied volatility falls sharply. This often happens after earnings announcements or major news events.

Here’s how it works:

| Before Event | After Event | Result |

| High volatility | Low volatility | Option loses value |

| Expensive options | Cheaper options | Your position drops |

Let’s say you buy a call option before earnings. You expect the stock to go up 5%. The stock does rise 5% after earnings, just as you predicted.

But your call option still loses money. The volatility dropped from 40% to 20% after the announcement. This drop in volatility made your option worth less, even though you were right about direction.

Volatility is often highest right before big events. After the event passes, volatility typically falls back to normal levels.

Your vega exposure determines how much you’ll lose from this volatility drop. Options with more time until expiration have higher vega. This means they lose more money when volatility falls.

Many new traders don’t understand this risk. They focus only on predicting price direction and ignore volatility changes.

Gamma Risk: High Delta Acceleration Turns Safe Trades Into Blowups Overnight

Gamma measures how fast your delta changes when the stock price moves. Think of it as the speed of change.

When gamma is high, your position can swing wildly. A small stock move creates big delta shifts.

The Hidden Danger

You might start with a safe delta of 0.20. But high gamma can push that delta to 0.80 in hours.

This happens most with options close to expiration. At-the-money options have the highest gamma risk.

Real-World Impact

Your “safe” covered call can turn into a major loss. The delta acceleration catches traders off guard.

Short options positions face the biggest gamma risk. You’re betting against this acceleration.

| Gamma Level | Risk | Delta Change |

| Low (0.01) | Minimal | Slow |

| Medium (0.05) | Moderate | Steady |

| High (0.15+) | Extreme | Rapid |

When Gamma Strikes

Stock gaps overnight create instant delta changes. Your position transforms while you sleep.

Weekly options in their final days show massive gamma. The risk multiplies as expiration approaches.

Many traders ignore gamma until it’s too late. They focus only on delta and get surprised by the acceleration.