What Is IV Crush and Why Does It Matter?

IV crush is a sudden drop in implied volatility right after big market events. This drop can wipe out option values, even if you guess the stock’s direction correctly.

Understanding IV crush is key for anyone trading options. It’s one of those risks that can sneak up on you.

How IV Crush Works

IV crush kicks in when implied volatility falls sharply after an event removes uncertainty. Before things like earnings or big news, traders snap up options, betting on big moves.

This buying pushes up both implied volatility and option prices. Once the event happens, everyone finally knows what’s going on.

The uncertainty disappears. That clarity makes implied volatility drop fast.

During IV crush, options lose value in two ways.

First, extrinsic value drops as volatility falls.

Second, time decay speeds up after the event.

So, you’ve got two forces working against you.

Let’s say you buy a call before earnings, hoping the stock jumps. Even if it does, your option might lose value anyway.

The drop in volatility can be bigger than the gain from the price move. It’s a bit of a gut punch.

At-the-money options get hit hardest since they’re loaded with extrinsic value. Options close to expiration also get slammed by IV crush.

Implied Volatility vs. Volatility Crush

Implied volatility is just the market’s guess about how much a stock might move. It’s all about uncertainty and, honestly, a bit of fear.

Higher implied volatility means people expect bigger swings. Volatility crush is the actual moment when that volatility drops.

The two are connected because the crush wipes out the extra premium baked into option prices. For example, before earnings, IV might shoot up to 80%.

After the news, it could fall to 30% in just a few hours. That’s a volatility crush in action.

Normal volatility depends on the stock, but it’s usually between 20% and 40%. During a crush, it can drop even lower.

The bigger the gap between before and after, the bigger the crush.

Market makers love this pattern—they sell expensive options before events and buy them back cheap after.

Events That Trigger IV Crush

Earnings announcements are the most common trigger. Companies report results, and all that uncertainty about performance vanishes in a flash.

FDA approvals for drug companies can create wild swings, too.

Product launches and big corporate news also set off IV crush. Think mergers, partnerships, or regulatory decisions.

Basically, if there’s a set date and a big yes-or-no outcome, watch out for volatility crush. Election results and Fed meetings shake up broad markets, and individual stocks can get caught in the crossfire.

Strike price and expiration date matter, too. Options expiring right after an event get hit the hardest, since there’s no time left to bounce back.

IV Crush Effects on Option Prices and Trades

Option premiums are made of intrinsic value and time value. The time value part includes volatility pricing.

When IV crush hits, that volatility piece drops fast. A typical example: option prices can fall 20-40% overnight after earnings.

Doesn’t matter if the stock moves in your favor. Before earnings: High volatility pumps up all option prices.

After earnings: Volatility drops and premiums deflate across the board. Options with more time left lose more premium than those expiring soon.

Here’s what matters for how much you lose:

- How high IV was before the event

- How much the stock actually moved versus what was expected

- Time left until expiration

- How close the option is to the money

Why Just Guessing Direction Isn’t Enough

Getting the stock direction right doesn’t guarantee profits. The market bakes in an “expected move.”

If a stock jumps 5% but the market expected 8%, IV crush still happens. You might lose money even if you were “right.”

Example:

- Stock: $100

- Expected move: $8 (8%)

- Actual move: $5 (5%)

- Result: IV crush, even though the direction was correct

Even a 10% move can leave you with losses or break-even. The drop in volatility premium often wipes out any gains from the price move.

So, you need to be right about both direction and size. Otherwise, IV crush can turn a good idea into a losing trade.

Who Wins and Who Loses from IV Crush

Option buyers usually take the biggest hit during IV crush. Long calls and puts both drop in value fast when volatility falls.

These positions can lose money overnight:

- Long calls

- Long puts

- Long straddles

- Long strangles

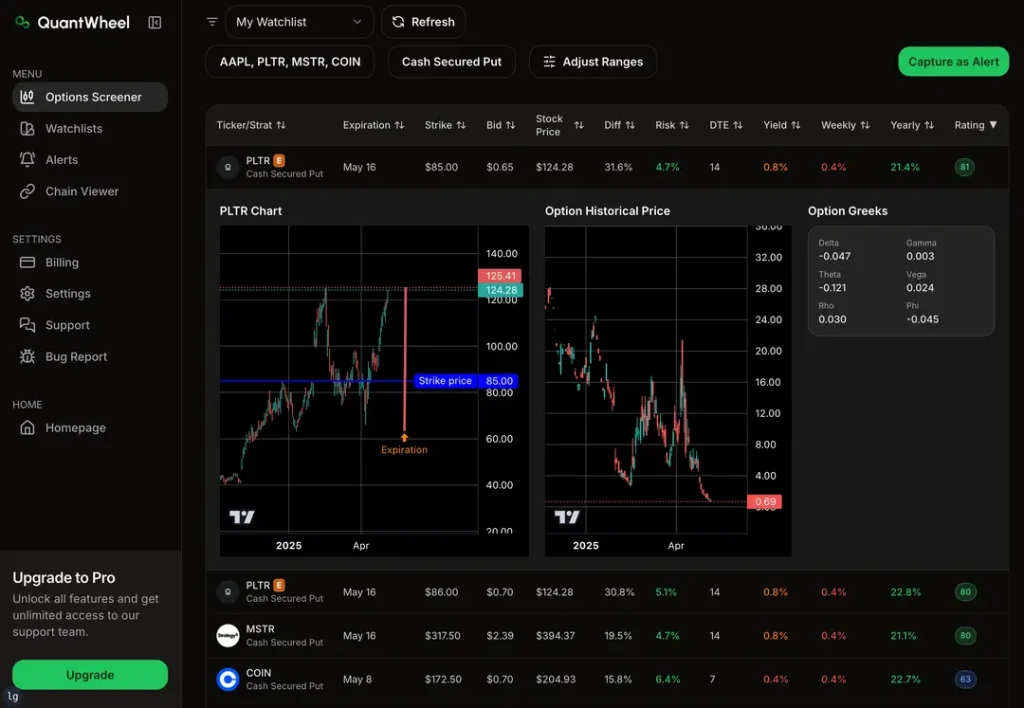

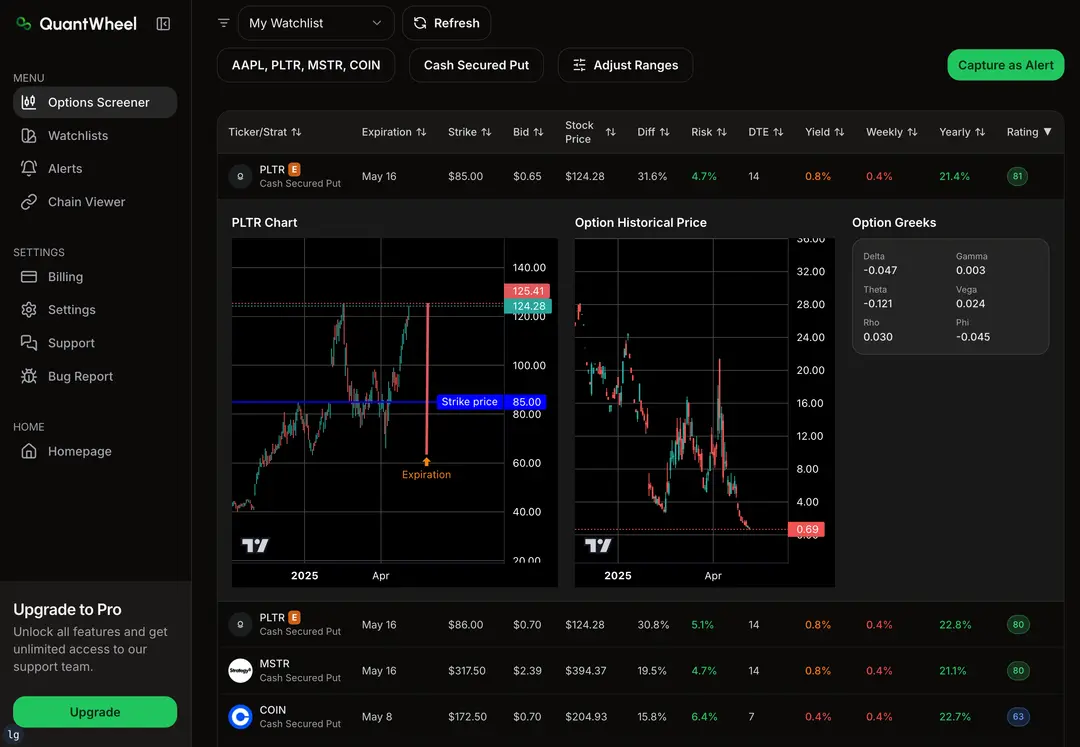

Option sellers often come out ahead during IV crush. They collect fat premiums before earnings and profit as those premiums shrink.

Winning trades include:

- Short calls (covered calls)

- Short puts (cash-secured puts)

- Short straddles

- Short strangles

- Iron condors

The more premium you collect up front, the more you can make when IV drops. But don’t get cocky—one big, unexpected move can wipe out those gains and then some.

Managing IV Crush: Strategies and Real Examples

Good traders use certain tricks to dodge IV crush losses—or even profit from them. You need sharp timing and solid risk management, but it’s definitely possible.

Popular Ways to Avoid IV Crush

Getting out before earnings is the classic move. Lots of traders close their options trades a day or two before earnings to sidestep the volatility drop.

Spread strategies help limit risk. Iron condors are popular—they work best when a stock stays in a certain range after earnings.

You collect premium and know exactly how much you could lose. Position sizing is huge here: use only a small piece of your money on any one trade, maybe 2-5% tops.

Some traders use calendar spreads to play the difference in time decay. They sell short-term options expiring after earnings and buy longer-term ones.

This setup profits from the faster decay of the near-term contract. Avoiding single-leg trades like just buying calls or puts before earnings is smart—they’re the most exposed to IV crush.

When IV Crush Creates Opportunity

Selling options before earnings can be a steady moneymaker if you’re careful. You collect higher premiums and profit as volatility drops back to normal.

Short straddles and strangles shine when the actual move is smaller than expected. If SPY is supposed to move $5 but only moves $2, sellers keep most of the premium.

Credit spreads offer limited risk and can profit from IV crush. Bull put spreads and bear call spreads collect premium that melts away after earnings.

The trick is spotting when volatility is much higher than usual. There are plenty of tools out there to help you find these setups.

Iron butterflies work well when you think a stock won’t move much after news. You profit from both time decay and falling volatility at the same time.

Real IV Crush Examples

Apple (AAPL) earnings: Before results, calls might cost $3.00 with the stock at $150. After earnings, even if AAPL jumps to $155, that call could drop to $2.50 as volatility fades.

Netflix: Someone bought puts expecting a drop after subscriber numbers. Netflix fell 8%, but the puts lost money because the market had priced in a 12% move.

Tesla: Traders sold iron condors before Tesla’s delivery numbers. The stock moved just 3% instead of the 8% expected. That position made a quick 60% profit from IV crush.

Pharma stocks and FDA approvals can see wild volatility spikes—sometimes 200-300% IV before a decision. Smart traders set up to win no matter which way the news goes.

Pros focus on the volatility environment, not just guessing the outcome. That’s where the real edge is.