Choosing the right strike price can make or break your options trade. The strike price determines how much profit you can make and how likely your trade will succeed. Most new traders pick random strikes without understanding the basics.

Your strike price choice depends on whether you want the option to be in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM) compared to the current stock price. ITM options cost more but have higher success rates. OTM options are cheaper but riskier. ATM options sit right in the middle.

Your trading goals and risk tolerance should guide your decision. If you want higher chances of profit, pick ITM strikes. If you want bigger potential returns with more risk, choose OTM strikes. The key is matching your strike choice to your strategy and market outlook.

Understanding Strike Prices in Options Trading

Strike prices determine the exact price at which you can buy or sell an underlying asset through your options contract.

The relationship between strike prices and current stock prices creates three key positions: ATM (at-the-money), ITM (in-the-money), and OTM (out-of-the-money).

What Is a Strike Price?

A strike price is the fixed price written into your options contract. This price stays the same from when you buy the contract until it expires.

You also hear strike prices called exercise prices. Both terms mean the exact same thing.

When you exercise your options contract, you buy or sell the underlying asset at the strike price. This happens no matter what the current market price is.

ATM options have strike prices equal to the current stock price. ITM options are profitable to exercise right now. OTM options would lose money if exercised today.

How Strike Prices Relate to Underlying Assets

Your strike price creates a direct relationship with the underlying stock or asset. The difference between these two prices determines your option’s value.

When the stock price moves above your strike price, call options become more valuable. When the stock price falls below your strike price, put options gain value.

ITM call options have strike prices below the current stock price. ITM put options have strike prices above the current stock price.

OTM call options have strike prices above the current stock price. OTM put options have strike prices below the current stock price.

Difference Between Call and Put Strike Prices

Call options and put options use strike prices in opposite ways. Call options give you the right to buy at the strike price. Put options give you the right to sell at the strike price.

For call options, lower strike prices cost more money. Higher strike prices cost less money. This happens because lower strikes are more likely to make money.

For put options, higher strike prices cost more money. Lower strike prices cost less money. Higher put strikes protect you better when stock prices fall.

ITM calls have strikes below the stock price. ITM puts have strikes above the stock price. Both types of ITM options cost more than OTM options.

Factors to Consider When Choosing a Strike Price

Your strike price decision depends on your market forecast, the premium you want to pay, how much risk you can handle, and when the option expires. Each factor works together to shape your trading strategy.

Market Outlook and Analysis

Your market analysis should drive your strike price choice. If you expect a stock to rise strongly, buying ITM call options gives you more exposure to price moves but costs more upfront.

ATM options balance cost and profit potential. They respond well to price changes in either direction.

OTM options cost less but need bigger price moves to become profitable. Use these when you forecast large market moves.

Consider your price target when picking strikes. If a stock trades at $100 and you expect it to reach $110, buying a $105 call might work better than a $115 call.

Study technical indicators and fundamental data before choosing. Your analysis quality affects your strike price success more than any other factor.

Volatility and Option Premium Impacts

High volatility makes all options more expensive. When volatility is high, OTM options become very costly compared to normal times.

Low volatility periods offer cheaper premiums across all strike prices. This creates opportunities to buy ITM options at better prices.

ATM options have the highest time value. They lose value fastest as expiration approaches if the stock stays flat.

ITM options hold value better because they contain intrinsic value. OTM options can lose their entire premium if the stock doesn’t move enough.

Check the implied volatility before trading. High implied volatility means expensive premiums. Low implied volatility means cheaper options but potentially smaller profits.

Risk Tolerance and Reward Expectations

Your risk tolerance determines which strikes make sense for your portfolio. Conservative investors often choose ITM options because they have intrinsic value and lower risk.

Aggressive traders may prefer OTM options for their higher reward potential. These options can double or triple in value with the right market move.

ATM options suit moderate risk tolerance levels. They offer balanced exposure without extreme premium costs.

Consider how much you can afford to lose. Options can expire worthless, so never risk money you can’t lose completely.

Match your strike choice to your profit goals. Smaller account sizes might benefit from OTM options to maximize leverage.

Time Until Expiration

Time affects different strikes in different ways. ATM options lose time value fastest because they have the most time premium built in.

ITM options hold value better as expiration approaches. Their intrinsic value protects against time decay.

OTM options face an uphill battle against time. They need significant price moves to overcome time decay.

Longer expiration dates give you more flexibility with strike prices. You can choose strikes further OTM because you have more time for the market to move.

Shorter expiration periods require more conservative strike selection. Choose ATM or ITM options when you have less time.

Weekly options need very precise timing and strike selection. Monthly or quarterly options offer more room for error in your strike price choice.

How to Select the Right Strike Price for Your Strategy

Your strike price choice affects your profit potential, risk level, and how your options trade responds to market changes. The key factors include understanding moneyness levels, using Greeks to predict price behavior, and matching your strike selection to your specific trading strategy.

ITM, ATM, and OTM Strike Prices Explained

ITM options have strike prices that are already profitable if exercised today. For calls, this means the strike is below the current stock price. For puts, the strike is above the current stock price.

ITM options cost more but offer higher delta. This means they move closer to dollar-for-dollar with the underlying stock.

ATM options have strike prices at or very close to the current stock price. These options balance cost with potential returns.

ATM strikes typically have the highest time value. They also offer moderate delta exposure.

OTM options have strike prices that would be worthless if exercised today. Calls have strikes above the stock price. Puts have strikes below the stock price.

OTM options cost less but need larger stock moves to become profitable. They offer lower delta but higher percentage gains when they work.

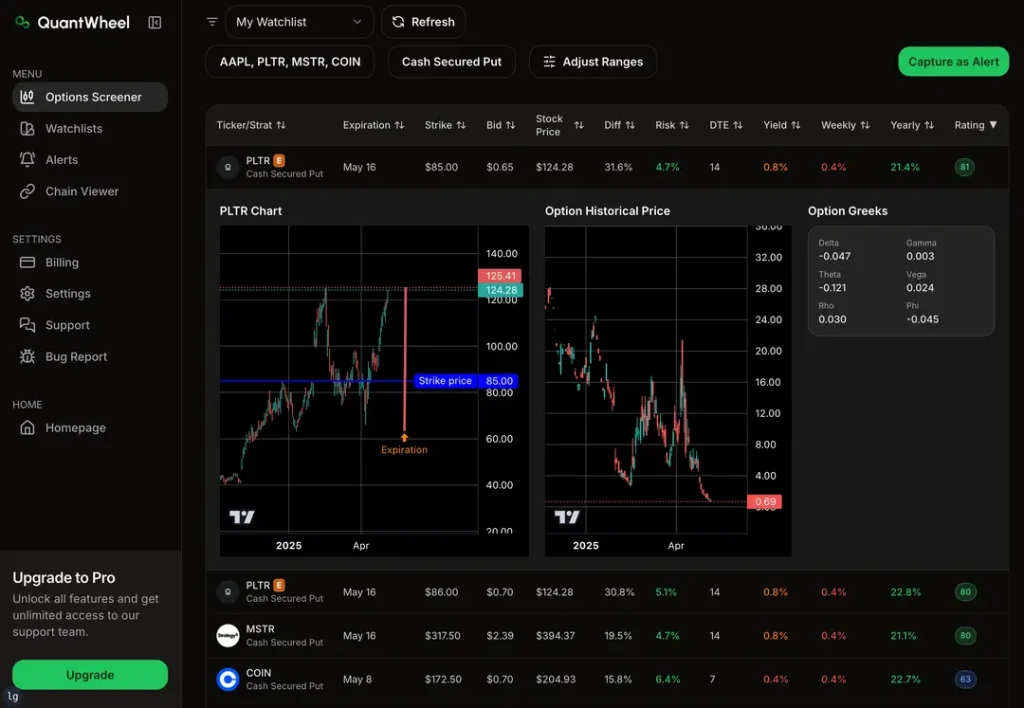

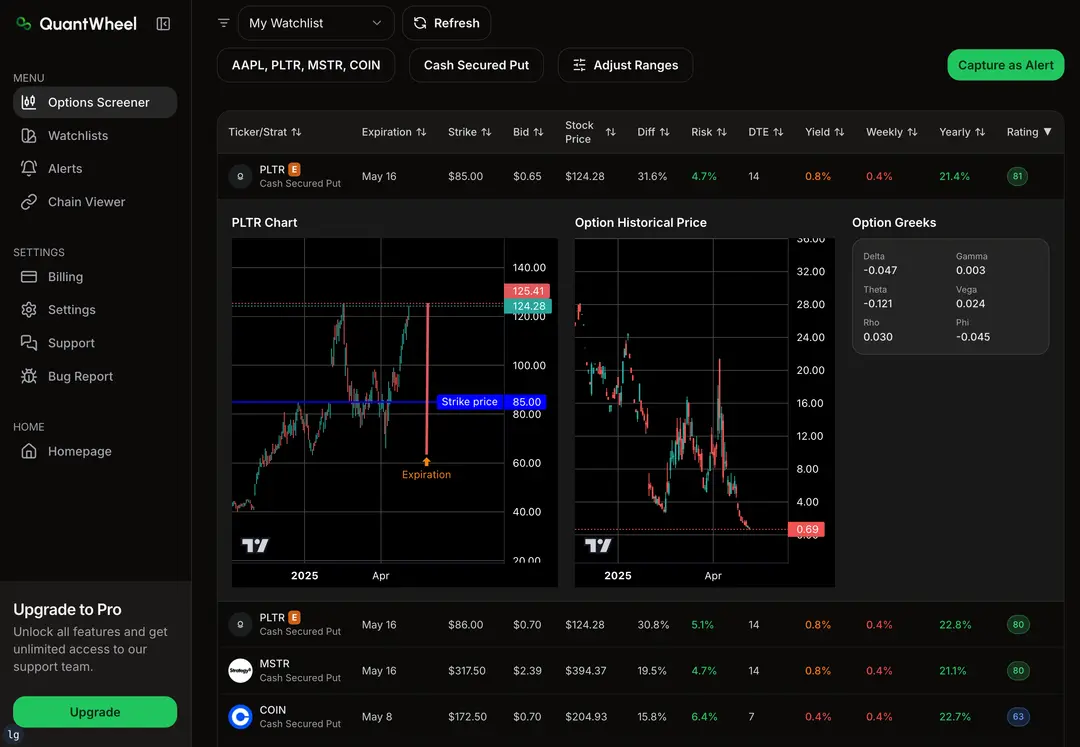

Using the Greeks for Decision Making

Delta tells you how much your option price changes for each $1 move in the stock. Higher delta means more price sensitivity.

ITM options have delta closer to 1.00 for calls or -1.00 for puts. OTM options have delta closer to zero.

Gamma shows how fast delta changes as the stock moves. ATM options typically have the highest gamma values.

Theta measures time decay. OTM options lose value faster as expiration approaches. ITM options hold value better.

Vega measures sensitivity to volatility changes. ATM options usually have the highest vega. This means they gain more when volatility increases.

Use these Greeks to predict how your options trade will behave. High delta works for directional plays. High gamma can amplify gains but also increase risk.

Aligning Strike Price with Options Strategies

Different options strategies work best with specific strike price selections. Your profit and loss profile changes based on your choice.

For covered calls, choose OTM strikes to collect premium while keeping upside potential. Select strikes 5-10% above the stock price.

For protective puts, pick OTM strikes to reduce cost while maintaining downside protection. Choose strikes 5-15% below current levels.

For cash-secured puts, use ATM or slightly OTM strikes. This maximizes premium collection while targeting your desired entry price.

Straddles and strangles work best with ATM strikes for maximum time value. The high vega helps when volatility increases.

Iron condors need OTM strikes on both sides. Pick strikes that give you adequate premium while staying outside expected price ranges.

Match your strike selection to your market outlook and risk tolerance. Each case requires different considerations based on your specific trading goals.

Practical Examples and Tips for Picking a Strike Price

Choosing the right strike price depends on market conditions, your risk tolerance, and profit goals. Smart investors avoid common mistakes by understanding how ATM, ITM, and OTM options perform in different scenarios.

Comparing Strike Prices in Different Market Conditions

In bull markets, OTM calls offer the highest profit potential. If you buy a stock at $50 and expect it to hit $60, choosing a $55 strike price costs less than a $50 ITM option.

ATM options work best when you’re unsure about direction. They balance cost and profit potential. For example, if a stock trades at $100, the $100 strike gives you flexibility.

During volatile markets, ITM options provide more safety. A $45 call on a $50 stock already has $5 in value. This reduces your risk if the stock drops slightly.

Bear markets favor ITM puts for protection. If you own shares at $80 and buy $85 puts, you lock in most gains even if prices fall.

Consider time decay too. OTM options lose value faster as expiration approaches. ITM options hold value better but cost more upfront.

Common Mistakes Beginners Make

New traders often pick OTM strikes because they’re cheap. This seems smart but creates high risk. These options expire worthless if the stock doesn’t move enough.

Another mistake is ignoring time until expiration. Buying OTM calls one week before expiration rarely works. The stock needs huge moves to make profit.

Beginners also pick strikes too far from current prices. A $20 call on a $50 stock needs the price to more than double. This happens but not often.

Many new investors don’t calculate breakeven points. Your $55 call that costs $2 needs the stock above $57 to profit. Factor in these costs before you trade.

Don’t chase cheap options without checking volume. Low-volume strikes have wide bid-ask spreads. You might pay $1.50 for an option worth $1.00.

Maximizing Profit and Managing Losses

Set profit targets before you buy. If your OTM call doubles, consider selling half. This locks in gains while keeping upside potential.

Use stop-losses on options trades. If your call loses 50% of its value, exit the trade. Options can go to zero quickly.

ITM options give you more control over losses. You can exercise early if needed. OTM options offer no protection once they move against you.

Consider rolling strikes when trades move in your favor. If you bought $50 calls and the stock hits $55, sell and buy $60 calls with the same expiration.

Diversify your strike prices across your portfolio. Don’t put all money in one strike. Mix ITM, ATM, and OTM positions based on your outlook.

Track implied volatility before picking strikes. High volatility makes all options expensive. Wait for calmer periods to get better entry prices.