Get the mechanics of time value cleared up and theta decay explained to help you leverage acceleration strategies for better trading returns.

Acceleration refers to how the time value of an option decreases faster as the option gets closer to its expiration date. This means the closer you are to expiration, the quicker the option loses its value every day. Understanding this can help you better time your trades and manage risks when dealing with options.

You might notice that the loss of value from time decay isn’t steady. Instead, it speeds up, especially in the last few weeks before expiration. Knowing how this works can give you an edge, especially if you use specific strategies that benefit from this faster rate of time decay.

By learning to recognize theta decay acceleration, you can improve how you set up your trades and protect your investments. You’ll also be able to decide when to enter or exit positions to make the most of this natural option trait.

Understanding Theta Decay Acceleration

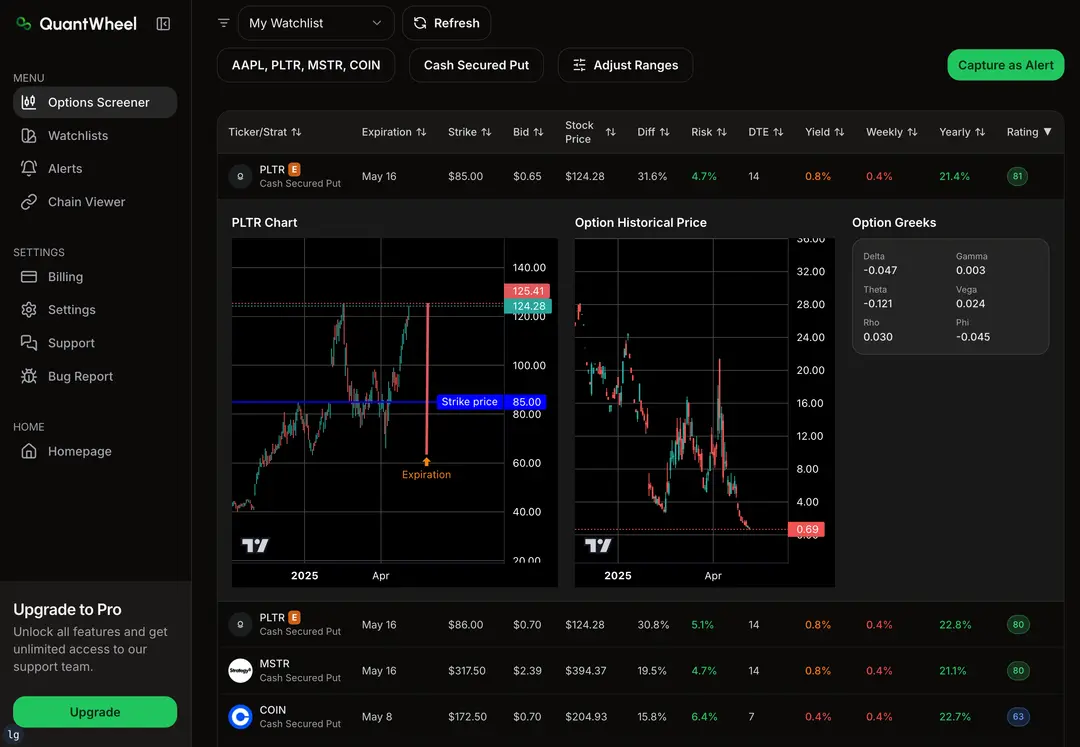

Theta decay speeds up how an option’s value drops as time passes. This process depends on the time left until expiration, the option’s price relative to the stock, volatility, and factors called Greeks that measure risk and sensitivity.

Time Value and Premium Erosion

Time value is the extra price an option holds beyond its intrinsic value. As an option gets closer to expiration, this time value melts away, causing the option’s premium to drop.

You lose more premium faster when there are only a few days left. Early in the option’s life, time decay is slow. But in the last 30 days, decay picks up sharply.

This matters because time decay affects profits and losses. If you sell options, accelerated theta decay can work for you. But if you buy options, time decay is a risk to your investment.

Impact of Expiration and Moneyness

Expiration date is the key driver of theta decay speed. Options near expiration lose time value faster than those with months left.

Moneyness determines how option value changes as time passes:

- In-the-money (ITM): Has intrinsic value, so theta decay is slower.

- At-the-money (ATM): Highest time value and fastest decay.

- Out-of-the-money (OTM): Mostly time value but small decay since intrinsic value is zero.

Traders watch these categories to decide when to enter or exit positions and manage risk effectively.

Role of Volatility and Option Pricing

Volatility affects option premium by changing expected price swings of the underlying asset. Higher volatility means a higher premium because of increased risk.

When volatility drops near expiration, it lowers option price and speeds up theta decay. But high volatility can sometimes slow theta decay by keeping premiums elevated.

You must track volatility changes closely. It causes option price swings that affect your strategy and portfolio value alongside time decay.

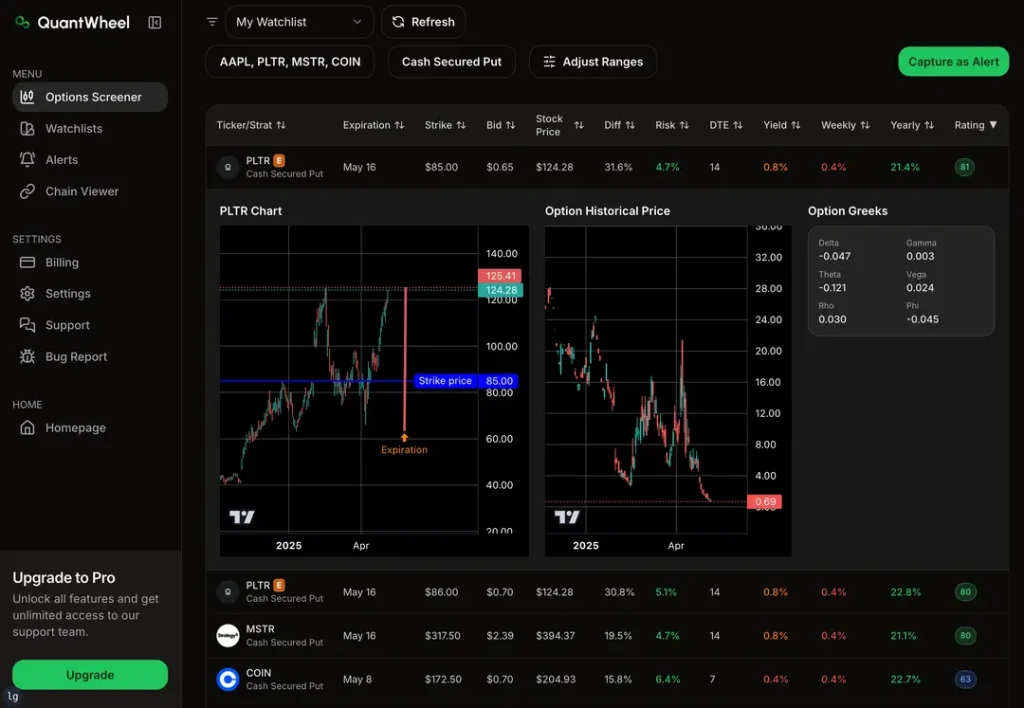

Influence of Greeks: Theta, Delta, and Gamma

Theta tells you how much value your option loses daily just by time passing. It grows larger as expiration nears, especially for ATM options.

Delta measures how much the option price moves when the stock price changes. It influences how much intrinsic value changes but not time decay.

Gamma measures how delta changes with the stock price. Higher gamma means your option reacts strongly to small price moves. This can affect sensitivity to theta decay.

Understanding how these Greeks interact helps you predict theta decay’s impact on options and control risk in your trades.

Trading Strategies Leveraging Accelerated Theta Decay

You can use accelerated theta decay to improve your option trading results by focusing on time-sensitive positions. Using short-term options, calendar spreads, and risk management methods helps balance rewards and losses in your portfolio.

Short-Term Option Positions

Short-term option positions benefit the most from accelerated theta decay. When you buy or sell calls or puts near expiration, the option’s price drops faster each day.

You can sell out-of-the-money (OTM) call options to collect premiums. Since these options lose value quickly, you keep more money if the price stays the same or moves slightly.

Buying in-the-money (ITM) options may cost more, but selling short-term at-the-money (ATM) options lets you profit from the option’s time decay. Be cautious with the direction of the market because rapid losses can happen if the price moves sharply.

Calendar Spreads and Income Generation

Calendar spreads use options with different expiration dates but the same strike price. You sell a near-term option while buying a longer-term option.

This structure takes advantage of accelerated theta decay on the short-term option, creating income without as much risk. It works well if the underlying asset stays near the strike price.

The debit paid upfront is limited, and the spread can reduce the impact of sudden price moves. Calendar spreads are popular for traders who want steady income but want to avoid heavy losses due to rapid time decay.

Risk Management and Portfolio Hedging

Using accelerated theta decay can help you reduce risk in your portfolio. Selling short-term options allows you to collect premiums that offset losses in other positions.

You can hedge by selling call options on assets you already own, which creates extra income and protects against minor price drops.

Always monitor your account because theta decay can accelerate losses quickly if the market moves against you. Proper adjustment or closing positions early can limit damage to your financial assets and risk exposure.