Welcome, here you’ll learn how options delta Greeks work together to shape your trading decisions.

Options delta is a key Greek that measures how much an option’s price will change when the price of the underlying asset moves. It shows you how sensitive an option contract is to changes in the stock price, helping you understand potential gains or losses. Knowing delta helps you manage risk and make better trading decisions.

Delta values range from -1 to 1, with call options having positive delta and put options having negative delta. This means if the stock price moves by $1, the option’s price will move roughly by the delta amount. Understanding this can improve your strategy whether you are buying or selling options.

By using delta, you get insights on the likelihood an option will expire in the money and how your portfolio’s value might change. This knowledge gives you more control over your trades and portfolio risk in the market.

Understanding Options Delta and the Primary Greeks

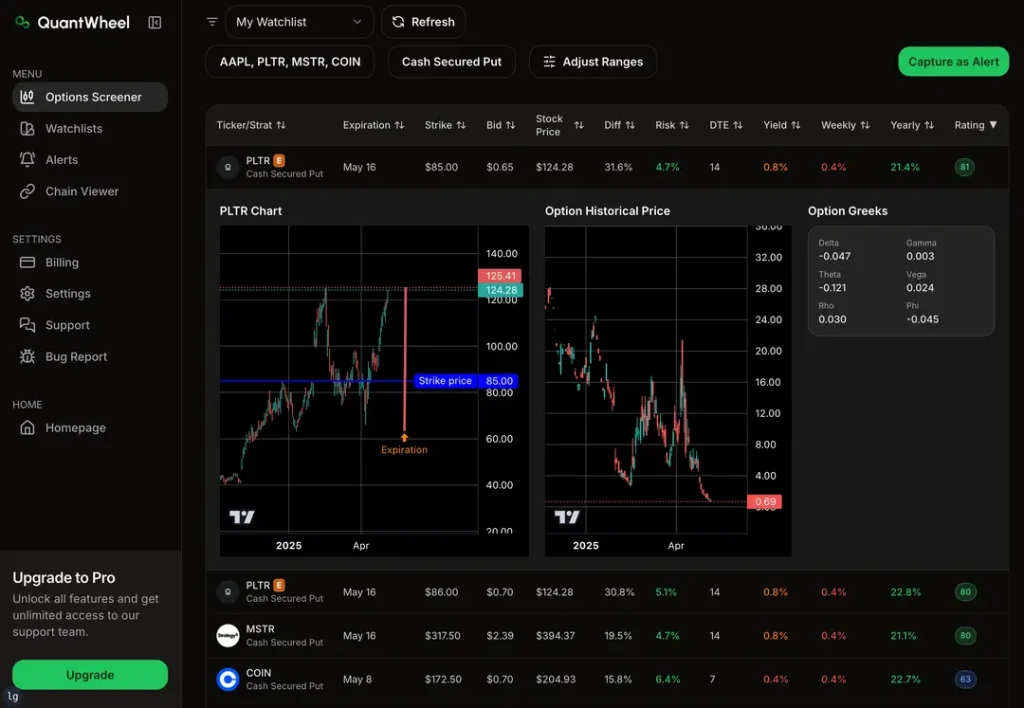

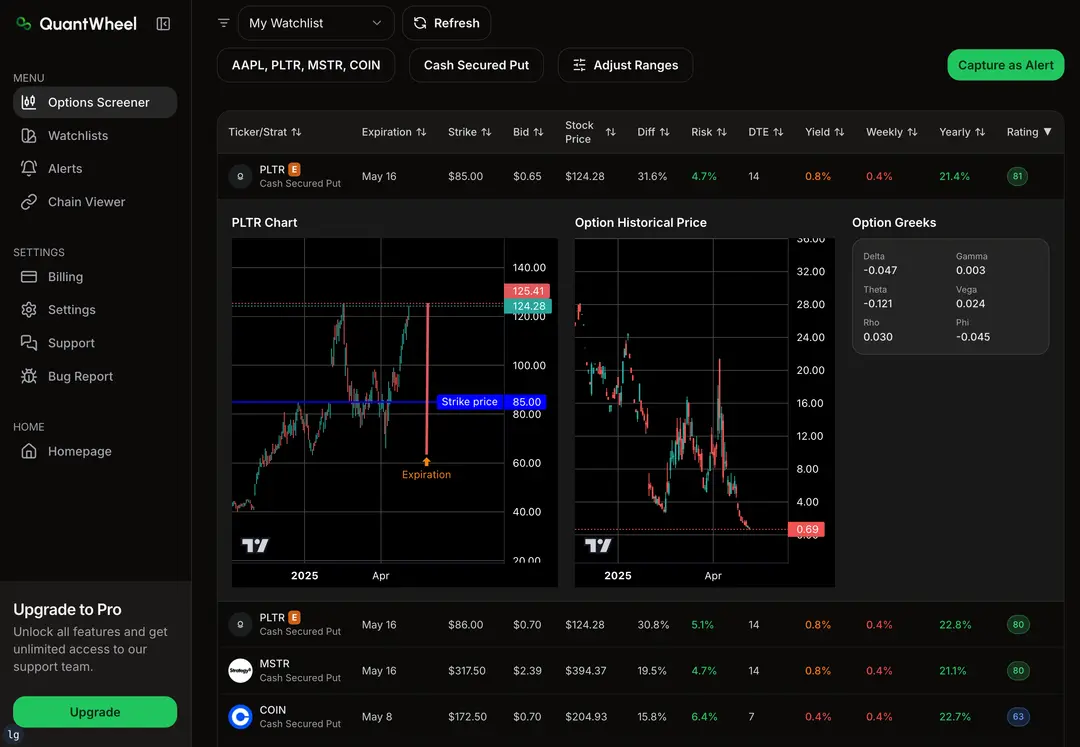

Options delta helps you understand how an option’s price moves compared to the stock price. Other Greeks like gamma, theta, vega, and rho measure different risks and sensitivities that impact the value and timing of your options.

What is Delta?

Delta is a number that shows how much an option’s price changes when the stock price moves by $1. For call options, delta ranges from 0 to 1. For put options, delta ranges from 0 to -1.

If a call option has a delta of 0.5, its price will change about $0.50 if the stock price changes by $1. Delta measures your contract’s price sensitivity to the underlying stock. It also gives insight into the chance of the option finishing in the money.

Delta also works as a hedge ratio in your portfolio. You can use it to balance risk by offsetting your stock exposure with options.

Relationship Between Delta and Price Movement

Delta changes as the stock price moves closer or further from the option’s strike price. When an option is deep in the money, delta moves closer to 1 or -1 because the option price moves almost like the stock.

Near expiration, delta changes faster. A small stock price move can cause a big change in your option’s value. This means your option’s sensitivity increases, but also risk and reward.

Your option’s premium is affected greatly by delta. High delta options cost more because they react strongly to price changes. Low delta options are cheaper but less sensitive to stock moves.

Gamma: Measuring Delta’s Rate of Change

Gamma shows how fast delta itself changes when the stock price moves by $1. It tells you about the acceleration of delta, not just the speed.

High gamma means your option’s delta will shift quickly, increasing or decreasing your price sensitivity fast. This is most important when the stock price is near the strike price.

Gamma is high for at-the-money options and drops for options far in or out of the money. Managing gamma helps you control exposure to rapid changes in price movement.

Gamma also plays a role in risk management, keeping your position balanced as delta changes in unpredictable ways.

Theta, Vega, and Rho Explained

Theta measures how much your option’s price drops as time passes, all else equal. This is called time decay. Options lose value faster as expiration nears.

Vega shows how sensitive your option is to changes in implied volatility in the market. If volatility rises, option prices usually rise, especially for at-the-money contracts.

Rho measures sensitivity to interest rate changes. It affects option prices less than the others but can matter if rates swing significantly.

All these Greeks together give a detailed picture of your option’s value changes based on price, time, volatility, and rates. You can use them to analyze risk and plan trades with more precision.

Applying the Delta Greeks in Options Trading

Understanding how delta works can help you manage risk and create smarter trades. You will learn how delta guides hedging, helps control portfolio risk, and plays a role in real trade decisions. This knowledge supports better moves in the options market.

Hedging Strategies Using Delta

Delta helps you create hedges to protect your investments. When you hold stocks, you can buy or sell options to balance price movements. For example, if you own 100 shares and want to limit downside risk, you might buy put options with delta close to -0.5. This means the put’s price will increase as the stock price falls, offsetting losses.

You can also sell call options against your stock to earn premium and reduce risk. Using delta, you know how many options to buy or sell to create a “delta-neutral” position. A delta-neutral hedge aims to make your overall position less sensitive to price swings. This reduces your exposure to sudden market moves.

Delta and Portfolio Risk Management

Delta plays a key role in managing portfolio risk. By tracking the total delta of all your positions, you understand how the portfolio will change if the stock moves up or down. If your portfolio’s delta is positive, it tends to gain value if the stock price rises. A negative delta means you benefit if prices fall.

You can adjust your portfolio by adding calls, puts, or stocks to reach a specific risk level. This helps you align your positions with your market view. For example, if you expect little price action, you might reduce delta to lower risk. Using delta as a tool offers better control of your portfolio’s sensitivity to market changes.

Examples of Delta in Real Trades

Suppose you buy a call option with a delta of 0.6. If the stock goes up by $1, your option’s value will increase by about $0.60. This shows how delta measures the probability and size of price moves affecting your position.

If you sell a call with a delta of 0.4, you take on positive exposure to price increases and earn premium upfront. However, as the stock price rises, your risk grows because delta also rises.

You might also use delta to estimate how many options you need to hedge your stock shares. For instance, 100 shares with 1.0 delta can be protected by buying roughly two puts with delta -0.5 each. This logical use of delta helps you reduce losses and manage exposure more confidently in your trading.