The monthly returns wheel strategy is a popular options trading method that can generate steady income from your stock investments. This approach combines selling cash-secured puts and covered calls in a repeating cycle. Many traders use this strategy to earn monthly premiums while potentially owning stocks they want to keep long-term.

The wheel strategy works by selling puts on stocks you want to own, then selling calls if you get assigned the shares. When you sell a put, you collect a premium and agree to buy the stock at a set price if it drops. If you end up owning the stock, you then sell covered calls to generate more income.

This strategy appeals to investors who want regular cash flow from their portfolios. You can earn money whether the stock goes up, down, or stays flat. The key is picking solid companies and strike prices that work with your investment goals.

Understanding the Monthly Returns Wheel Strategy

The wheel strategy generates consistent monthly income through selling cash-secured puts and covered calls. You can expect annual returns of 24-36% when executed properly with disciplined risk management.

Core Concepts of the Wheel Strategy

The wheel strategy involves two main phases that create a continuous cycle. You start by selling cash-secured puts on stocks you want to own. This means you hold enough cash to buy 100 shares if the option gets assigned.

When you sell puts, you collect premium income immediately. If the stock price stays above your strike price, the puts expire worthless and you keep the premium. You then repeat this process with new puts.

If the stock price drops below your strike price, you get assigned the shares. This moves you to phase two of the wheel strategy. Now you own the stock and can sell covered calls against your position.

Covered calls let you collect more premium while potentially selling your shares at a profit. If the calls expire worthless, you keep the premium and your shares. If the calls get assigned, you sell your shares and return to selling puts.

How Monthly Returns Are Generated

Monthly returns come from collecting options premiums every 30-45 days. You typically sell options with expiration dates that match this timeline. Each premium payment adds to your monthly income stream.

The key is selecting stocks that trade within predictable ranges. Volatile stocks offer higher premiums but carry more risk. Stable, dividend-paying stocks provide lower but more consistent premiums.

Your monthly yield depends on the premium amounts relative to your total capital. A $50 premium on a $5,000 cash position equals 1% monthly return. Annual returns of 24-36% break down to roughly 2-3% per month.

Premium amounts vary based on stock volatility, time until expiration, and how close the strike price sits to the current stock price. Out-of-the-money options provide lower premiums but higher success rates.

The Role of Options Premiums

Options premiums represent the cash you receive for selling puts and calls. This premium income forms the foundation of your monthly returns. Market makers pay you this premium because you take on the obligation to buy or sell shares.

Premium values change based on several factors. High volatility increases premiums because options become more valuable. Longer expiration dates also boost premiums since more time means more uncertainty.

The strike price you choose affects premium amounts significantly. Selling puts closer to the current stock price generates higher premiums but increases assignment risk. Selling calls closer to your purchase price maximizes premium but limits profit potential.

Time decay works in your favor as the option seller. Each day that passes reduces the option’s value, allowing you to potentially buy back your position for less than you received. This time decay accelerates as expiration approaches.

Implementing and Managing a Wheel Strategy Portfolio

Successful wheel strategy implementation requires careful portfolio construction with proper diversification across multiple stocks and sectors. You must assess risk levels regularly and use specific techniques to protect your capital from significant losses.

Portfolio Construction and Diversification

You should allocate no more than 5-10% of your total capital to any single stock position when running the wheel strategy. This prevents one bad assignment from damaging your entire account.

Choose 8-12 different stocks across various sectors like technology, healthcare, and consumer goods. Focus on stocks trading between $20-100 per share to keep cash requirements manageable. Each stock should have strong fundamentals and steady trading volume above 500,000 shares daily.

ETFs work well for wheel strategies because they offer built-in diversification. Popular choices include SPY, QQQ, and IWM. These require more capital but reduce single-company risk.

Set aside 20-30% of your portfolio as cash reserves. This money covers potential assignments and gives you flexibility during market downturns. Without adequate cash, you might face forced liquidations at poor prices.

Start with 3-4 positions as a beginner. Add more stocks only after you gain experience managing assignments and rolling trades effectively.

Risk Assessment and Mitigation Techniques

Monitor your portfolio’s total risk exposure daily by tracking all open positions and potential assignment values. Your maximum risk should never exceed 70% of your available capital.

Use stop-loss rules for assigned shares. If a stock drops 15-20% below your assignment price, consider selling to limit losses. This prevents small problems from becoming major capital destroyers.

Delta management helps control risk levels. Keep your total portfolio delta between -0.20 and +0.30. This range limits your exposure to large market moves while maintaining income potential.

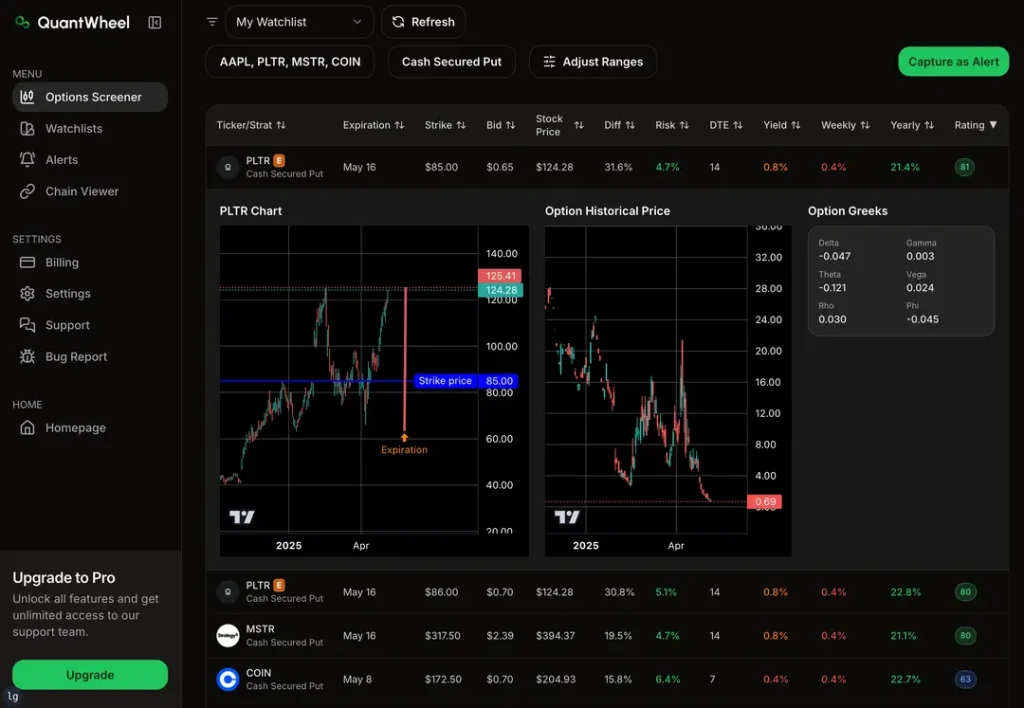

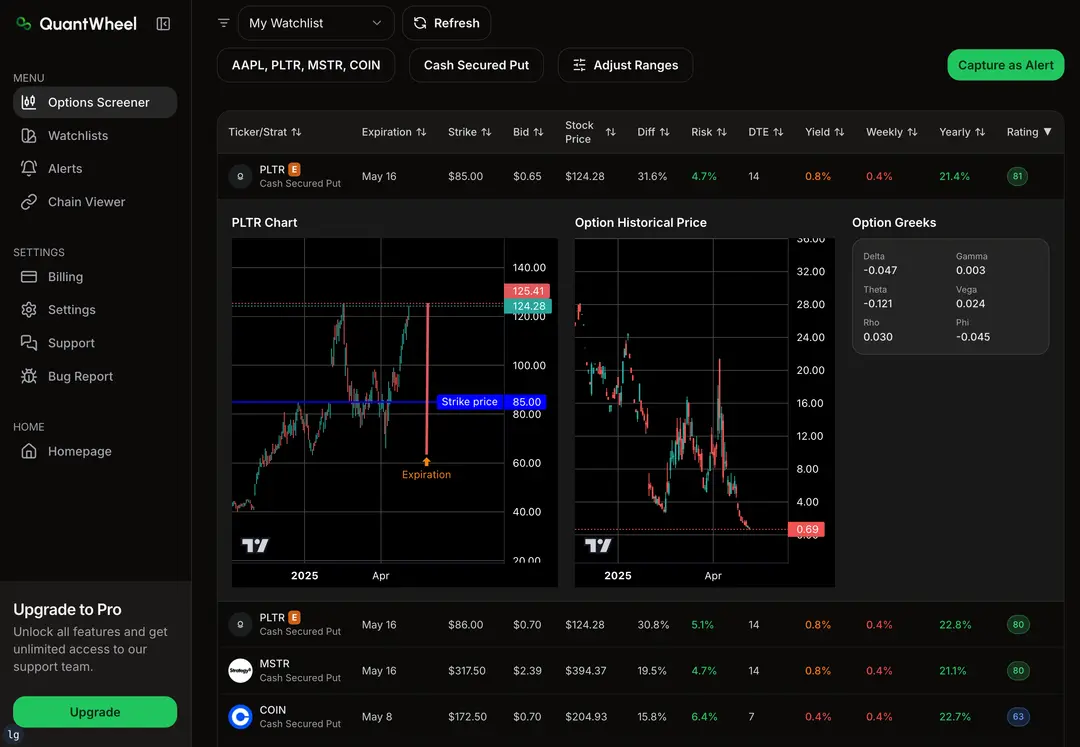

Choose strike prices carefully based on technical support levels. Selling puts 5-10% below current market prices reduces assignment probability while maintaining decent premium income.

Track implied volatility levels before entering trades. Avoid selling options when volatility sits below the 20th percentile. Wait for volatility spikes above the 40th percentile to maximize premium collection.

Monitoring Performance and Adjusting Trades

Review your positions every trading day to check for early assignment notices and profit opportunities. Most brokers send assignment notifications after market close on the assignment date.

Calculate your monthly returns by dividing total premium collected by capital at risk. Target returns of 1-3% per month depending on market conditions and volatility levels.

Roll losing trades when they reach specific thresholds. If a short put moves 20-30% against you, consider rolling to a later expiration or lower strike price. This gives the trade more time to work in your favor.

Track key performance metrics including win rate, average profit per trade, and maximum drawdown. Successful wheel traders typically achieve 60-75% win rates with average monthly returns of 1-2%.

Adjust position sizes based on market volatility. Reduce exposure during high-stress periods when the VIX exceeds 30. Increase activity when volatility drops below 15 and premium income becomes harder to generate.